Loading

Get Ky 42a741 2001-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the KY 42A741 online

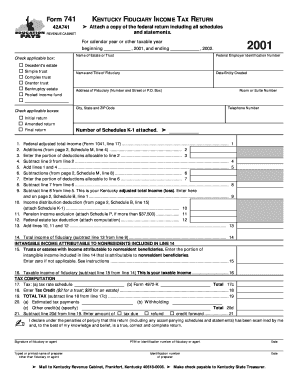

Filling out the KY 42A741 form, the Kentucky fiduciary income tax return, is crucial for ensuring compliance with state tax regulations. This guide provides clear instructions on how to accurately complete the form online.

Follow the steps to fill out the KY 42A741 form accurately.

- Click ‘Get Form’ button to obtain the form and open it in your editor. This will allow you to start filling out the KY 42A741 online.

- Enter the beginning and ending dates for the taxable year in the designated fields at the top of the form. Ensure these dates reflect your tax reporting period.

- Select the applicable box for the type of fiduciary entity, such as simple trust, complex trust, or others, by checking the corresponding option.

- Fill in the federal employer identification number (FEIN) and the name and title of the fiduciary. These details are critical for identifying the entity responsible for the fiduciary tax return.

- Complete the address fields with the fiduciary's mailing address, including street number, city, state, and ZIP code. Optional details like room or suite number should also be added if applicable.

- Indicate whether this is the initial return, an amended return, or a final return by checking the appropriate box.

- Input the number of attached Schedules K-1, if applicable. This is important for reporting distributions to beneficiaries.

- Continue to the income section and provide the federal adjusted total income as obtained from Form 1041. Complete subsequent lines related to additions and subtractions as indicated.

- Calculate the Kentucky adjusted total income and ensure to account for any deductions that apply. Follow the specific guidelines for each allocation and complete the form accurately.

- Review the tax computation section carefully and enter any applicable credits. Complete the total tax lines to determine tax due or refund.

- Finally, ensure the declaration statement is signed by the fiduciary or their agent. Include printed names, identifying numbers, and dates as required.

- Once the form is complete, you can save changes, download, print, or share the form as needed for your records or submission.

Begin filling out the KY 42A741 form online today to ensure timely and accurate tax reporting.

Related links form

Persons not domiciled in Kentucky but who live in Kentucky for more than 183 days during the tax year are also considered residents; however, since they are not full-year residents they must use Form 740-NP. Individuals who established or abandoned Kentucky residency are considered part-year residents.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.