Loading

Get Il Imrf 5.10 2013-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IL IMRF 5.10 online

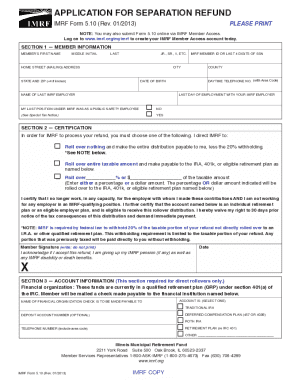

This guide is designed to assist users in completing the IL IMRF Form 5.10, Application for Separation Refund. It offers detailed instructions to ensure a smooth and accurate filling process for your separation refund request.

Follow the steps to complete your IL IMRF 5.10 form correctly.

- Select the ‘Get Form’ button to obtain the IL IMRF 5.10 online form and open it in your preferred editor.

- In Section 1, enter your member information, including your first name, middle initial, last name, IMRF member ID or the last four digits of your social security number, and your current contact details including your mailing address and phone number.

- Provide your date of birth, name of your last IMRF employer, and the last day you worked with that employer. Confirm whether your last position was as a public safety employee by selecting ‘Yes’ or ‘No’.

- Proceed to Section 2, where you need to choose how you want to receive your refund. Check ‘Roll over nothing’ if you prefer to receive the entire amount directly, keeping in mind that IMRF will withhold 20% for tax purposes. Alternatively, select ‘Roll over entire taxable amount’ if you wish to have your refund rolled over to an IRA or another eligible plan.

- If you are rolling over a portion of your refund, indicate the percentage or dollar amount in the provided space. This segment requires certification about your employment status and acknowledgement of the implications of accepting the refund.

- In Section 3, complete the rollover account information if applicable. Specify the name of the financial institution and account type where the rollover funds will be directed. Make sure to provide any necessary account numbers.

- After filling out all relevant sections, review your information for accuracy. You may want to save your changes, download, print, or share the form according to your needs.

Complete your IL IMRF Form 5.10 online today for a seamless application process.

To be fully vested in IL IMRF 5.10, you typically need to work for a minimum of 8 years in an eligible position. Being vested means you have earned the right to receive pension benefits when you retire. Therefore, it’s essential to plan your career with this timeline in mind. You can consult the IL IMRF website or speak with a representative for detailed guidance on your specific situation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.