Loading

Get Sc Wh-1601 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC WH-1601 online

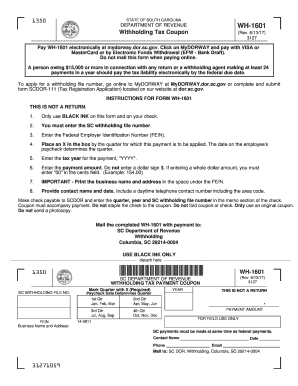

The South Carolina WH-1601 form is used for submitting withholding tax payments electronically. This guide provides clear and concise instructions to assist users in completing the form accurately and efficiently.

Follow the steps to complete the WH-1601 form online.

- Click ‘Get Form’ button to open the SC WH-1601 form in your preferred document management tool.

- Use only black ink for all entries on the form and on any accompanying check to ensure clarity and compliance.

- Enter your South Carolina withholding file number in the designated field, ensuring accuracy for proper processing.

- Provide your Federal Employer Identification Number (FEIN) in the appropriate section, as this identifies your business.

- Select the applicable quarter for which the payment is being made by placing an X in the corresponding box. The quarter is determined by the paycheck date of your employees.

- Input the tax year of the payment in the format YYYY to indicate the correct tax period.

- Enter the payment amount without including a dollar sign. If you are entering a whole dollar figure, remember to include '00' in the cents field (e.g., for $154, enter '154.00').

- Print the business name and address directly under the FEIN to ensure it matches the information in your tax records.

- Include your contact name and date in the designated spaces, alongside a daytime telephone contact number with the area code.

- Make your check payable to SCDOR and note the quarter, year, and South Carolina withholding file number in the memo section. Ensure the coupon accompanies the payment.

- Do not staple the check to the coupon, and refrain from folding any documents. Always use an original coupon without any photocopies.

- Review the filled-out form for any errors, then save the changes, and download or print the form as required. This will allow you to submit it along with your payment.

Complete your withholding tax payments accurately by filling out the WH-1601 online.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Employee instructions Complete the SC W-4 so your employer can withhold the correct South Carolina Income Tax from your pay. If you have too much tax withheld, you will receive a refund when you file your tax return.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.