Loading

Get Form 433i-payment Agreement Application Revenue

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 433I-Payment Agreement Application Revenue online

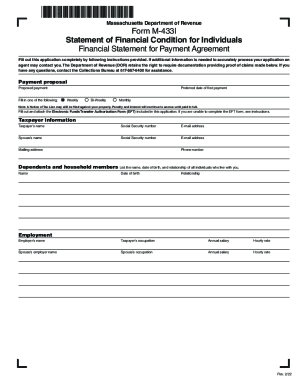

Completing the Form 433I-Payment Agreement Application is essential for individuals seeking a payment agreement with the Massachusetts Department of Revenue. This guide provides detailed, step-by-step instructions to assist you in accurately filling out the form online, ensuring that you meet all requirements and avoid unnecessary delays.

Follow the steps to fill out the Form 433I accurately and efficiently.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Start with the payment proposal section. Here, indicate your proposed payment amount and preferred date for the first payment. Check the box corresponding to your choice of payment frequency: weekly, bi-weekly, or monthly.

- Proceed to the taxpayer information section. Fill in your name, social security number, and email address. If applicable, also include your partner's name, social security number, and email.

- In the dependents and household members section, list the names, dates of birth, and relationships of all individuals living with you.

- Next, move to the employment section. Enter your and your partner's employer names, occupations, and incomes, specifying annual salary and hourly rates.

- Complete the property details by providing the addresses of any real property you own, categorizing them as primary residence, secondary, or investment properties. Include their assessed values.

- List your assets in the designated section, including bank accounts, retirement accounts, vehicles, and other items valued at $5,000 or more. Ensure accurate account numbers and current balances.

- Fill out the monthly income section, detailing various sources of income, including net incomes, rental income, business income, pensions, and other applicable entries. Calculate your total monthly income.

- In the monthly expenses section, provide details of your recurring monthly expenses by listing expenses such as food, rent, insurance, utilities, and child care. Sum these expenses for a total.

- Report your debt obligations, including credit cards and other loans, with minimum monthly payments and remaining balances.

- Sign and date the form. If completing electronically, type your name in the designated fields. If submitting by mail, ensure that you physically sign the application.

- Finally, review all filled information for accuracy, then save changes, download, or print the completed form for submission.

Complete your Form 433I-Payment Agreement Application online to take the first step towards managing your tax obligations.

Contact Center hours are 9 a.m. – 4 p.m., Monday through Friday. (617) 887-6367 or (800) 392-6089 (toll-free in Massachusetts)

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.