Loading

Get Nj Dot L-9 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NJ DoT L-9 online

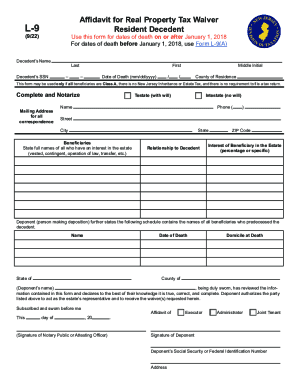

This guide provides step-by-step instructions for filling out the NJ DoT L-9 form online, ensuring that you have all the necessary information to complete it accurately. The NJ DoT L-9 form is vital for individuals seeking a tax waiver for real property after the death of a resident decedent.

Follow the steps to complete the NJ DoT L-9 form online.

- Click the ‘Get Form’ button to access the L-9 document and prepare it for filling out.

- Begin with the decedent's name and Social Security number. Enter the last name, first name, and middle initial in the respective fields.

- Indicate the county of residence at the time of death in the provided field.

- Select whether the decedent left a will (testate) or did not leave a will (intestate).

- Fill in the mailing address for all correspondence, including the name and phone number of the contact person.

- List all beneficiaries' names who have an interest in the estate, along with their relationship to the decedent and their percentage or specific interest in the estate.

- Include a schedule of beneficiaries who predeceased the decedent, providing their names, dates of death, and states of domicile.

- Have the deponent, the individual making the affidavit, review all provided information and declare its truthfulness. This person's signature is required.

- Complete the real estate description section for each property associated with the decedent by providing county, street address, lot, block, and municipality details.

- Ensure all required documents are attached, including the will, property deed, and death certificate.

- Finalize the form by saving your changes, and utilize options to download, print, or share it as needed.

Complete the NJ DoT L-9 form online now and ensure all necessary documents are properly filed.

Who Files the New Jersey Inheritance Tax Return? Unless you fall under a Class A beneficiary, the responsibility falls on the estate's Personal Representative to file the appropriate tax return and pay the tax. Payment accompanies the return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.