Loading

Get Ks St-28f 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the KS ST-28F online

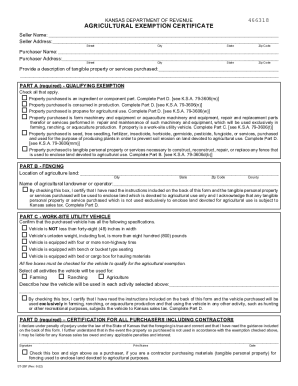

The Kansas ST-28F form serves as an agricultural exemption certificate, allowing eligible purchasers to claim tax exemptions on specific agricultural purchases. This guide provides clear, step-by-step instructions for successfully completing the form online.

Follow the steps to complete the KS ST-28F form online.

- Click the 'Get Form' button to access the KS ST-28F online form and open it in an editable format.

- Fill in the seller's name and address. Ensure that you provide accurate details, including the street, city, state, and zip code.

- Enter the purchaser's name and address in the corresponding fields. Similar to the seller's section, include details such as the street, city, state, and zip code.

- Provide a description of the tangible property or services purchased. Be specific about what items or services qualify for the exemption you are claiming.

- Complete Part A by checking all applicable exemptions. Make sure to review the exemptions that pertain to your purchase, such as ingredients, consumables, or machinery.

- If applicable, proceed to Part B to provide the necessary details regarding fencing. State the location of the agricultural land and the owner's name.

- In Part C, confirm the specifications of any work-site utility vehicle. Ensure you check all required boxes to qualify for the exemption.

- Fill out Part D by signing the certification statement, acknowledging that the information provided is true and correct. Include your printed name and date.

- Once you have filled out all relevant sections, review the form for accuracy. Save your changes and choose to download, print, or share the completed form.

Complete your KS ST-28F form online today and ensure you are eligible for the appropriate agricultural tax exemptions!

Does Kansas have a resale certificate? Most businesses operating in or selling in the state of Kansas are required to purchase a resale certificate annually. Even online based businesses shipping products to Kansas residents must collect sales tax. Obtaining your sales tax certificate allows you to do so.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.