Loading

Get Al Form 40es 2022

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AL Form 40ES online

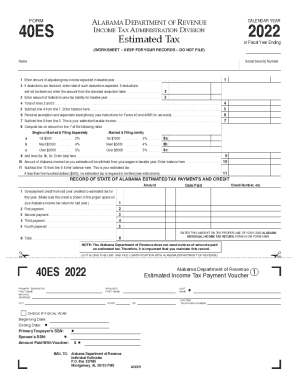

Filling out the AL Form 40ES online is an essential task for individuals anticipating their estimated income tax obligations in Alabama. This guide provides clear step-by-step instructions to help users complete the form accurately and efficiently.

Follow the steps to complete your AL Form 40ES online.

- Click ‘Get Form’ button to access the form and open it in your preferred online editor.

- Input your full name and Social Security Number in the designated fields at the top of the form. Ensure that this information is accurate to avoid processing delays.

- Enter your expected adjusted gross income for the taxable year in line 1. This figure is crucial as it determines your overall tax obligation.

- For line 2, if you have itemized deductions, input the total amount expected. If you will not itemize, use the amount from the standard deduction table.

- On line 3, state your federal income tax liability for the taxable year. This information assists in calculating your overall tax responsibility.

- Add the amounts from lines 2 and 3 to determine your total deductions and enter this value on line 4.

- Subtract the total from line 4 from the amount in line 1 and enter the resulting balance in line 5.

- Fill in line 6 with your personal exemption and any dependent exemptions. Refer to the instructions for the specific amounts.

- Subtract line 6 from line 5, and enter this calculated amount as your estimated taxable income on line 7.

- For line 8, compute the tax based on your estimated taxable income. Follow the specified tax rates for singles or married individuals filing jointly, and enter final amounts on lines 8a, 8b, and 8c.

- Add the totals from lines 8a, 8b, and 8c, and record this total on line 9.

- On line 10, document any Alabama income tax estimated to be withheld from your wages for the taxable year.

- Deduct the amount on line 10 from the total on line 9 and enter the result in line 11, which represents your estimated tax. If it is less than $500, note that no estimated tax needs to be filed.

- Finally, save your changes. You can also download, print, or share the completed form as needed for your records.

Begin completing your AL Form 40ES online today to ensure timely and accurate filing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.