Loading

Get De 200-02-x Instructions 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the DE 200-02-X Instructions online

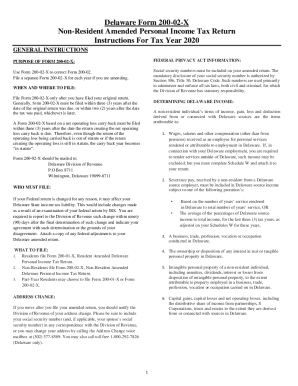

Filling out the DE 200-02-X, Non-Resident Amended Personal Income Tax Return, requires careful consideration to ensure accuracy and compliance. This guide provides step-by-step instructions for completing the form online, making the process straightforward for all users.

Follow the steps to successfully complete the DE 200-02-X form online.

- Press the ‘Get Form’ button to access the DE 200-02-X form and open it in your document editor.

- Review the general instructions provided at the beginning of the form to understand its purpose and the relevant deadlines for filing.

- In the section titled 'Name, Address, and Social Security Number,' ensure that you accurately enter your information as it appears on the original return. Include your social security number.

- For the filing status field, select the appropriate status based on your circumstances. If you are changing your filing status, ensure the new selection is checked.

- Proceed to the income information section. Enter values for wages, dividends, interest, and any necessary adjustments from your Delaware source income as specified in the instructions.

- Complete the sections regarding adjustments, including any entries related to pensions, IRA distributions, and any federal adjustments applicable based on your Delaware source income.

- Once all entries are complete, review the entire form for accuracy and completeness. Make sure to rectify any information that may have errors.

- Finally, save your form after making all necessary changes. You can either download it, print it out for mailing, or share it according to your filing needs.

Complete your DE 200-02-X forms online today to ensure timely submission!

ing to Delaware Instructions for Form 200-01, “If you are a Full-Year Resident of Delaware, you must file a tax return for 2022 if, based on your Age/Status, and if your individual adjusted Delaware gross income (AGI) exceeds the limit. Single: Under age 60, $9,400. Age 60 to 64, $12,200.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.