Loading

Get Or Request For Corrected W-2 (w-2c) 2011-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the OR Request For Corrected W-2 (W-2c) online

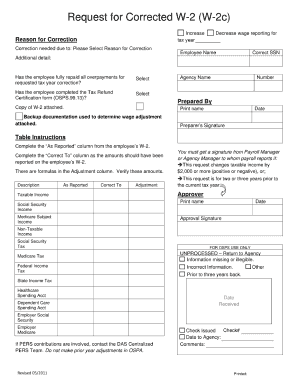

Filling out the OR Request For Corrected W-2 (W-2c) online is an important step to correct any discrepancies in your wage and tax information. This guide will provide you with clear, step-by-step instructions to help you complete the form accurately.

Follow the steps to fill out the OR Request For Corrected W-2 (W-2c) online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your personal information in the designated fields. This includes your name, address, and Social Security number. Ensure that all details are accurate as they will be used to verify your identity.

- Next, proceed to the section that requires information about the employer. Enter the employer’s name, address, and Employer Identification Number (EIN) correctly. This information is crucial for the processing of your request.

- In the subsequent section, specify the tax year for which you are requesting the correction. It is important to select the correct year to avoid any processing delays.

- Then, describe the reason for correction in the provided box. Be as clear and specific as possible to help expedite the correction process.

- After filling in the required fields, review your information thoroughly to ensure its accuracy. Any errors may lead to further complications.

- Once all sections are completed, you can save your changes, download, print, or share the W-2c form as needed.

Complete your OR Request For Corrected W-2 (W-2c) online today to ensure your tax records are accurate.

Related links form

If you have received a Form W-2C (a corrected W-2 form), you can still electronically file your return. Enter the information from your Form W-2C as a Form W-2 in the program, if you have not yet entered the original Form W-2, or correct the original Form W-2 information entered.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.