Loading

Get Ca Ftb 3805v Instructions 2009-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 3805V Instructions online

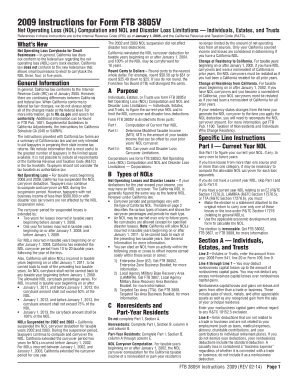

Filling out the CA FTB 3805V form can be a straightforward process when you have the right guidance. This comprehensive guide offers clear steps to help individuals, estates, and trusts accurately complete the form online, ensuring all necessary information is correctly filled out.

Follow the steps to complete your CA FTB 3805V online.

- Press the ‘Get Form’ button to obtain the form and access it for editing.

- Begin by reviewing the general information provided in the instructions to understand the Net Operating Loss (NOL) computation and applicable limitations.

- In Part I, compute your current year NOL. Make sure to enter all relevant financial figures, including total income and losses, in the designated fields.

- If applicable, complete Part II to determine your Modified Taxable Income (MTI). This will require adjustments based on your taxable income to calculate how much can be carried over.

- Move to Part III to document the NOL carryover and disaster loss carryover limitations. Carefully track the expiration of any unused carryovers.

- If you are a nonresident or part-year resident, ensure you follow the specific instructions outlined for your residency status, modifying your entries appropriately.

- Once all sections are completed, review your entries to ensure accuracy. You can then save your changes, download, print, or share the completed form.

Start filling out your CA FTB 3805V form online today!

116-136, in 2020 significantly changed the historic treatment of net operating losses (NOLs) for federal income tax purposes. The TCJA provisions, specifically, limit allowable NOL deductions to 80% of federal taxable income and lift the previously imposed 20-year limitation on carryovers.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.