Loading

Get Au Cs4645 2021-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AU CS4645 online

The AU CS4645 form is essential for providing a statement of financial details necessary for establishing a suitable repayment plan for overdue child support. Completing this form accurately ensures that Services Australia can assess your circumstances effectively and work with you towards a manageable repayment solution.

Follow the steps to complete the AU CS4645 online.

- Press the ‘Get Form’ button to access the AU CS4645 form and open it in your preferred editor.

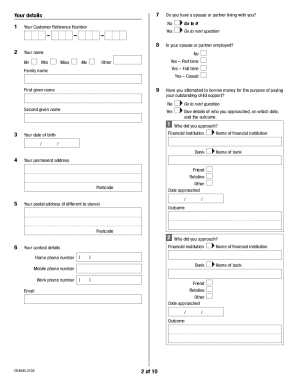

- Begin by entering your personal details in the designated sections, including your customer reference number, name, and date of birth. Ensure that all information is accurate and matches your official identification documents.

- Indicate whether you have a spouse or partner living with you. Depending on your response, navigate to the next relevant question about their employment status.

- Proceed to fill out your financial details, such as income sources, expenses, assets, and liabilities. It is crucial to provide comprehensive and truthful information as it assists in determining a feasible payment arrangement.

- Once you reach the payment offer section, reflect on your financial situation to propose an amount that demonstrates your capacity to pay. This amount will be evaluated by Services Australia based on your stated financial condition.

- At the end of the form, sign and date the declaration to confirm that the information provided is correct and complete. Ensure you have included any necessary supporting documents as specified.

- Finally, you can save your changes, download the form, print it, or share as needed. Review all sections to ensure no information is missing before submission.

Complete your AU CS4645 form online today to ensure timely processing of your child support repayment plan.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.