Loading

Get Assumption Agreement 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Assumption Agreement online

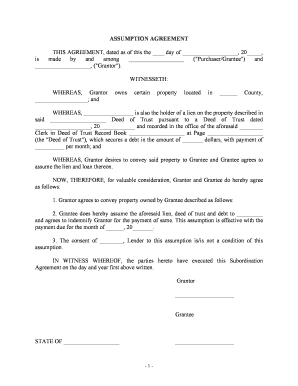

The Assumption Agreement is a legal document used to outline the terms under which one party agrees to take over the obligations of a loan or lien from another party. This guide provides detailed, step-by-step instructions on how to fill out this agreement online, ensuring that the process is clear and accessible for all users.

Follow the steps to complete the Assumption Agreement online.

- Click ‘Get Form’ button to obtain the document and open it in your preferred online editor.

- In the first blank space, enter the date of the agreement, formatted as 'Day Month Year'.

- Fill in the names of the parties involved: the purchaser/grantee and the grantor, in the designated areas.

- In the section referencing the property, clearly specify the location of the property, including county and other necessary details.

- Enter the details of the lien, including the original Deed of Trust date and the recording information, ensuring accuracy to avoid any legal issues.

- Specify the debt amount and the monthly payment amount in their respective fields.

- State whether the consent of the lender is required for the assumption by marking the appropriate option.

- Have both parties sign in the designated sections, ensuring that full names are included.

- Complete the notary acknowledgment section, entering the date of acknowledgment and the notary public details as required.

- Finally, review the completed document for accuracy before saving, downloading, printing, or sharing it as needed.

Complete your Assumption Agreement online today to ensure a smooth transaction.

An assumable mortgage allows a buyer to take over the seller's mortgage. Once the assumption is complete, you take over the payments on a monthly basis, and the person you assume the loan from is released from further liability.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.