Get Stony Brook University Verification Of Income For Parent Non-tax Filers 2019-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Stony Brook University Verification Of Income For Parent Non-Tax Filers online

This guide provides a detailed overview of how to complete the Stony Brook University Verification of Income for Parent Non-Tax Filers form online. By following these steps, users can ensure they accurately provide the needed information for a smooth submission process.

Follow the steps to complete the form effectively.

- Press the ‘Get Form’ button to access the form and open it in your preferred online editor.

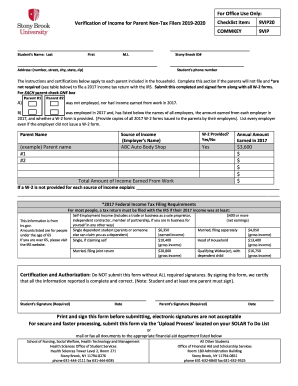

- Begin by entering the student’s last name, first name, and middle initial in the designated fields.

- Next, input the student’s Stony Brook ID number in the appropriate area.

- Fill out the address section, including the number, street, city, state, and zip code.

- Provide the student’s phone number in the specified field.

- For each parent included in the household, read the instructions carefully and indicate their employment status by checking the appropriate box for Parent #1 and Parent #2.

- If a parent was employed, list each employer’s name along with the total annual income earned in 2017 and indicate whether a W-2 form is provided.

- If W-2 forms are missing, provide an explanation in the space available.

- Calculate the total amount of income earned from all sources and enter that figure in the designated section.

- Ensure that both the student and at least one parent sign and date the form in the certification section.

- Once completed, save changes and either download the form, print it, or share it as needed.

Take action now and complete your documents online for a smooth experience.

To reach out to the international student office at Stony Brook University, you can find their email contact on the university’s official site. It is helpful to include your name, student ID, and specific questions regarding your status or support services. For matters related to finances or documentation, the Stony Brook University Verification of Income for Parent Non-Tax Filers can further clarify the resources available to you.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.