Loading

Get Freddie Mac 1077/fannie Mae 1008 2009

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Freddie Mac 1077/Fannie Mae 1008 online

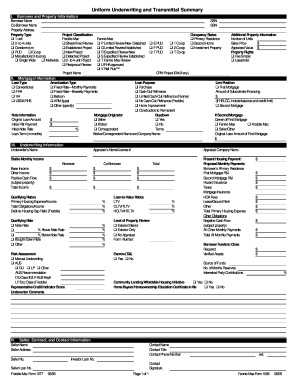

Filling out the Freddie Mac 1077 and Fannie Mae 1008 forms online is an essential step in the mortgage underwriting process. This guide provides a clear, step-by-step approach to help users accurately complete these important documents.

Follow the steps to fill out the Freddie Mac 1077/Fannie Mae 1008 online.

- Press the ‘Get Form’ button to access the Freddie Mac 1077/Fannie Mae 1008 form and open it in the editor.

- Begin by filling in the borrower and co-borrower names, along with their respective social security numbers. Make sure to enter the property address and select the property type from the given options, such as single unit or condominium.

- Complete the mortgage information section. Indicate the loan type and select the appropriate amortization type, whether conventional, FHA, VA, or USDA/RHS. Fill out the loan amount, payment details, and loan term in months.

- In the underwriting information section, provide the underwriter’s name, occupancy status, loan purpose, and details about the mortgage originator. Don’t forget to enter any supplementary income and total income amounts.

- Fill in the risk assessment fields by selecting the method of underwriting and entering any relevant AUS recommendation numbers, if applicable. Include qualifying rates and any necessary comments.

- Complete the seller, contract, and contact information section. Enter the seller’s details, original loan amount of the first mortgage, and any borrower funds or verified assets.

- For additional property information, input the number of units and sales price, followed by the appraised value. Ensure to review each section for accuracy.

- Once all sections are filled out thoroughly, you can save your changes, download, print, or share the form as needed.

Start completing your Freddie Mac 1077 and Fannie Mae 1008 forms online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Freddie Mac 1077 and Fannie Mae 1008 serve different purposes in the mortgage market. Freddie Mac focuses more on providing liquidity to smaller lenders, while Fannie Mae works primarily with larger lenders. Both help increase the availability of mortgage credit, but they have distinct guidelines and criteria. Understanding these differences can aid you in selecting the best option for your mortgage needs.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.