Loading

Get Lgl 002 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the LGL 002 online

Filling out the LGL 002 form online can be done efficiently with organized steps. This guide provides detailed instructions to help you navigate through each section of the form effortlessly.

Follow the steps to complete the LGL 002 form online.

- Press the ‘Get Form’ button to access the LGL 002 online and open it for editing.

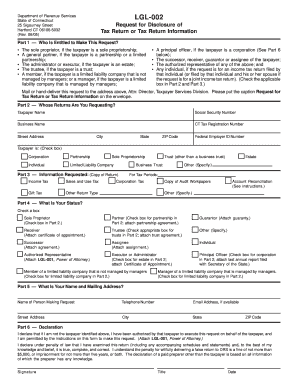

- In Part 1, determine who is entitled to make this request. Indicate the applicable party by checking the appropriate box based on your relationship with the taxpayer.

- Move to Part 2 and fill in the taxpayer’s information. Provide the taxpayer name, Social Security Number, business name, Connecticut Tax Registration Number, street address, city, state, ZIP code, and Federal Employer ID Number if applicable.

- In Part 3, specify the type of tax return or tax return information you are requesting. Select the appropriate tax type and enter the corresponding tax period for each requested form.

- Proceed to Part 4 to indicate your status. Check the box that reflects your relationship to the taxpayer. Attach any necessary documentation to support your status.

- Next, complete Part 5 by providing your name and mailing address. Ensure that your contact information is accurate so a representative can reach you if needed.

- Finally, review and sign the declaration in Part 6. Only the taxpayer or an authorized representative may sign this section. Make sure to attach any required documentation that supports your authority to make the request.

- Once all sections are filled, you can save your changes, download, print, or share the completed form as necessary.

Complete your LGL 002 form online now to ensure accurate and timely handling of your tax return requests.

Getting a copy of your Connecticut tax return is simple. You can request it online through the Connecticut Department of Revenue Services, or you can submit a written request by mail. Including pertinent information will speed up the process. The Lgl 002 service can guide you through these steps effectively.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.