Loading

Get Apgfcu Skip-a-pay Application 2021-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the APGFCU Skip-a-Pay Application online

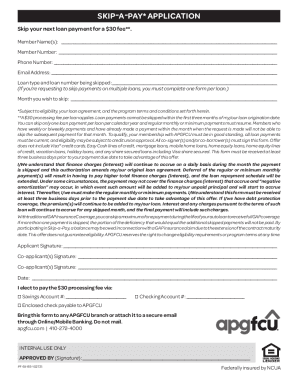

The APGFCU Skip-a-Pay Application allows members to defer their loan payments while managing their financial obligations. This guide provides a detailed overview of how to complete the application efficiently online.

Follow the steps to complete your application accurately.

- Click ‘Get Form’ button to access the Skip-a-Pay Application and open it in the editor.

- Begin by entering your member name(s) in the designated field. Ensure that the name(s) match the records associated with your membership.

- Fill in your member number accurately to help identify your account. This number is essential for processing your application.

- Provide your phone number in the required section. Ensure that the number is current and reachable for any follow-up questions.

- Enter your email address to receive confirmation regarding your application and any further communication from APGFCU.

- Indicate the type of loan and the loan number from which you wish to skip a payment. If you are skipping payments on multiple loans, note that a separate application is needed for each loan.

- Select the month for which you would like to skip your payment. Be mindful of the eligibility requirement that payments cannot be skipped within the first three months of the loan.

- Affix the signature of all applicants on the form. If there are co-applicants, ensure that their signatures are also included for validation.

- Choose a payment method for the $30 processing fee by indicating whether you will pay via savings account, checking account, or by enclosing a check payable to APGFCU.

- Review all entries for accuracy. Once confirmed, you can choose to save your changes, download, print the application, or share it as needed.

Complete your APGFCU Skip-a-Pay Application online to manage your loan payments effectively.

If you need to skip a payment, a payment deferment on a car loan will help you avoid repossession. Sometimes, your auto loan will even have a built-in deferment policy. Regardless, you can't defer a car payment without the approval of your lender.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.