Loading

Get Uk Hs304 Claim Form 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UK HS304 Claim Form online

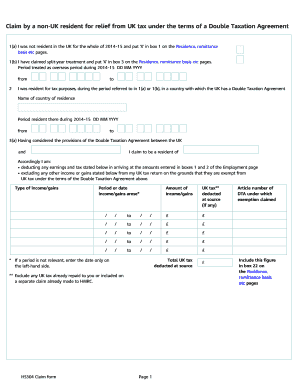

The UK HS304 Claim Form is essential for individuals who are not residents of the UK but wish to claim relief from UK tax under a Double Taxation Agreement. This guide will walk you through each section of the form, ensuring a clear understanding of the process.

Follow the steps to successfully complete the HS304 Claim Form online.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- In section 1(a), indicate your residency status in the UK by placing an ‘X’ in the appropriate box if you were not a UK resident for the entire tax year 2014-15. If applicable, also claim split-year treatment by marking box 3.

- Provide the period you were treated as overseas during the fiscal year in the format DD MM YYYY, specifying both start and end dates.

- In section 2, list the country in which you were a resident for tax purposes during the specified period, providing the relevant dates in DD MM YYYY format.

- In section 3(a), identify the Double Taxation Agreement that applies, and claim residency status accordingly. Document the type of income and its corresponding details, including amounts and UK tax deducted at the source.

- For section 3(b), claim partial relief from UK tax by providing details about the nature of income and the associated figures, including gross amounts and UK tax patterns.

- Answer sections 4 and 5 regarding previous applications and any other claims made to HMRC for the tax year, marking yes or no as applicable.

- In section 6, indicate if you were born before 6 April 1948, and if so, provide your reference. Follow the additional guidance for future applications if necessary.

- Sign and date the declaration, confirming that you are the beneficial owner of the income described and that the details provided are accurate.

- Once completed, review the form for accuracy, and save your changes. You may then download, print, or share the form as necessary.

Start filling out your UK HS304 Claim Form online today for a smoother tax relief process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Yes, there is a double tax treaty between the US and the UK. This treaty aims to prevent individuals and businesses from being taxed twice on the same income. It provides guidelines on which country has taxing rights over certain types of income. To navigate this efficiently, you may want to utilize the UK HS304 Claim Form in your application.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.