Loading

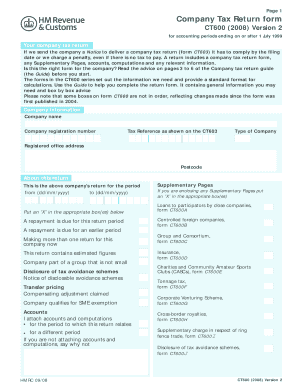

Get Uk Ct600 2008

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UK CT600 online

Completing the UK CT600 form online is a crucial process for companies to ensure compliance with tax regulations. This guide provides clear and detailed instructions on how to accurately fill out each section of the company tax return, catering to users with varying levels of experience.

Follow the steps to complete your online UK CT600 form.

- Press the ‘Get Form’ button to access the CT600 form and open it in your preferred editor.

- Begin filling out the company information section. Enter your company name, registration number, tax reference, and type of company. Make sure to provide the registered office address and postcode accurately.

- Specify the accounting period for this return by entering the start and end dates. Mark an 'X' in the appropriate box if a repayment is due or if any supplementary pages are included.

- In the company tax calculation section, input the total turnover from trade or profession in the dedicated box. Follow each subsequent box to accurately report profits, gains, and income details as required.

- Navigate to the deductions and reliefs section, where you will need to enter details about losses, expenses, and other deductions relevant to your return.

- Move on to the tax calculation section to compute the corporation tax chargeable based on the profits entered previously. Ensure to double-check the details entered for accuracy.

- Complete the repayments information, if applicable, by stating any amounts to be repaid and providing the necessary bank and contact details for payment.

- Finalize the form by reviewing all entries for accuracy. Once completed, save changes, download a copy for your records, print the form if needed, or share it as per your filing requirements.

Complete your UK CT600 form online now to ensure timely submission and compliance.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

You can file your own company tax return in the UK if you are confident in managing your company's financial information. The process involves filling out the UK CT600 and ensuring that all details are correct. For added support, consider exploring services from US Legal Forms, which can streamline your filing experience.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.