Loading

Get Ct Conn Uc-5a 2018-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT CONN UC-5A online

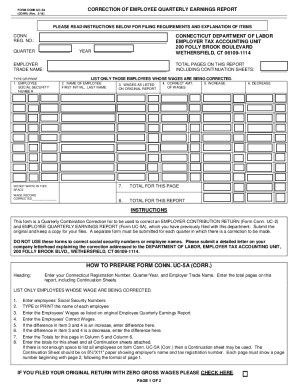

The CT CONN UC-5A form is used to correct employee quarterly earnings reports previously filed with the Connecticut Department of Labor. This guide will provide step-by-step instructions on how to accurately complete the form online, ensuring that all necessary corrections are processed efficiently.

Follow the steps to accurately complete the CT CONN UC-5A.

- Press the ‘Get Form’ button to access the CT CONN UC-5A form and open it in your editor.

- In the heading section, enter your Connecticut Registration Number, indicate the Quarter and Year, and provide your Employer Trade Name. Also, specify the total pages you are submitting, including any continuation sheets.

- List only those employees whose wages are being corrected. For each employee, provide their Social Security Number, type or print their name, enter the wages as listed on the original report, and the correct amount of wages.

- In the section for wage adjustments, calculate and enter the increase or decrease in wages based on the difference between the original report and the corrected amounts.

- Total the amounts for each column on the form. Ensure to enter the subtotal for this page and the total for the entire report, including any continuation sheets.

- If necessary, use a continuation sheet to list additional employees. The continuation sheet should include the employer’s name and tax registration number, and each page must be numbered consecutively.

- Once completed, review the form for accuracy. Save your changes, and then download or print a copy for your records before sharing or submitting the form according to the guidelines provided.

Start filling out the CT CONN UC-5A online to ensure accurate corrections of your employee wage reports.

Related links form

The 2022 SUI tax-rate factors remained the same as for 2021, with experience rates continuing to range from 1.9% to 6.8% (including the 1.4% solvency tax rate). Current UI law caps the solvency tax rate at 1.4%, with a decrease to 1.0% scheduled for 2024 under HB 6633.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.