Loading

Get Nh Dp-10 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NH DP-10 online

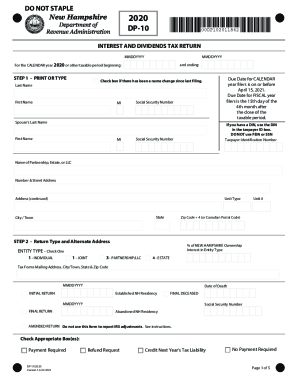

The NH DP-10 is an important form for reporting interest and dividends for tax purposes in New Hampshire. This guide provides clear, step-by-step instructions on how to complete the form online, ensuring you have all the necessary information at hand.

Follow the steps to complete the NH DP-10 online

- Press the ‘Get Form’ button to access the NH DP-10 document online, allowing you to open it in your preferred digital editor.

- Begin the form by entering your name, Social Security number, and address details. Ensure that all information is printed clearly or typed accurately.

- Indicate your return type by checking the appropriate box. This includes options like 'Initial Return,' 'Final Return,' or 'Amended Return'.

- Provide your interest and dividends information by entering the corresponding amounts from your federal tax return. This includes entry lines for interest income, dividend income, and federal tax-exempt interest.

- Calculate your total taxable income by summing your reported income and subtracting any non-taxable amounts or exemptions.

- Proceed to calculate your tax, credits, and payments by following the provided lines and making necessary calculations for any deductions.

- Review the form for accuracy before signing it. Ensure both parties sign if filing jointly.

- Once completed, save the changes made to the form and choose to download, print, or share it as needed.

Fill out your NH DP-10 form online today to ensure timely and accurate tax reporting.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

INDIVIDUALS: Individuals who are residents or inhabitants of New Hampshire for any part of the tax year must file if they received more than $2,400 of gross interest and/or dividend income for a single individual or $4,800 of such income for a married couple filing a joint New Hampshire return.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.