Loading

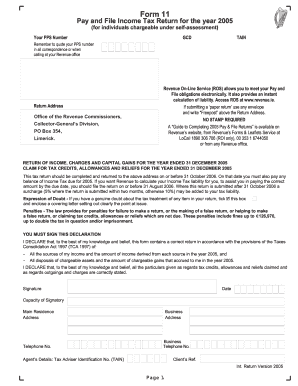

Get Ie Form 11 2005

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IE Form 11 online

The IE Form 11 is essential for individuals responsible for self-assessment of their income tax obligations. This comprehensive guide provides step-by-step instructions on accurately completing the form online, ensuring you meet your tax filing requirements efficiently.

Follow the steps to complete the IE Form 11 effectively.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in your Personal Details in Panel A, including your name, PPS number, and date of birth. Make sure to use capital letters and write clearly within the specified boxes.

- Complete Panel B regarding any income from trades, professions, or vocations. Provide necessary descriptions and financial figures where applicable.

- Fill out the details in Panel C for any exempt income you may have. Ensure you include all necessary entries related to exemptions.

- Proceed to Panel D, which covers income from fees, rents, and other distributions. Accurately report the amounts to ensure correct tax calculations.

- In Panel E, input your income from Irish employments, pensions, and directorships. Include any relevant expenses and tax deducted.

- Continue to Panel F if you have foreign income. Be sure to note the amounts correctly and indicate any foreign tax that applies.

- Complete Panels G to K, providing any additional income or claims for tax credits, allowances, and capital gains as relevant to your financial situation.

- Before submitting the form, review all entries for accuracy and completeness. Ensure that all required sections are completed.

- Save changes once you are satisfied with your form submission, and choose to download, print, or share the completed form as necessary.

Begin the process now to ensure your tax documents are completed and submitted on time.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The easiest way to fill out a tax return starts with being organized and having all necessary documents at hand. Utilize tools and platforms like USLegalForms that provide comprehensive templates and guidance to streamline the process. Remember to keep your completed IE Form 11 handy, as it plays a crucial role in determining your final tax liabilities.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.