Get Canada Rc59 E 2007

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada RC59 E online

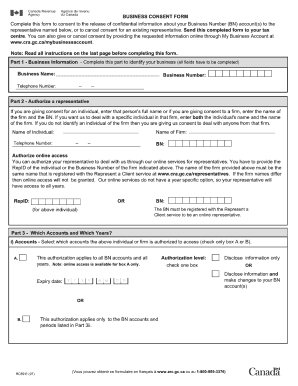

Filing the Canada RC59 E form online can streamline your process and ensure you meet all necessary requirements efficiently. This guide provides clear, step-by-step instructions to help you navigate each section of the form with confidence.

Follow the steps to fill out the Canada RC59 E form successfully.

- Click ‘Get Form’ button to access the RC59 E form and open it in the online editor.

- Begin by entering your personal information in the designated fields. This typically includes your full name, contact information, and any relevant identification numbers.

- Next, provide detailed information about your tax situation. This may include specifics regarding your income, deductions, and any applicable credits.

- Review the form carefully, ensuring that all provided information is accurate and complete. Double-check names, numbers, and any references to ensure they align with official documents.

- After the review, you can finalize your form by saving changes. The online platform generally offers options to download, print, or share the completed form directly from the interface.

Complete your Canada RC59 E form online today for a streamlined and efficient filing experience.

Get form

The RC59 form is a crucial document used in Canada for granting authorization for a representative to access your tax information from CRA. It simplifies the process for individuals who need assistance with their tax affairs. By using the Canada RC59 E form, you ensure that your representative handles your tax matters effectively. Understanding this form can make your tax experience smoother and more organized.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.