Loading

Get Il A/114 2019-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IL A/114 online

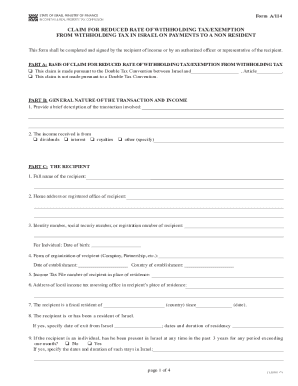

The IL A/114 form is essential for claiming a reduced rate of withholding tax or exemption from withholding tax in Israel on payments made to a non-resident. This comprehensive guide will walk you through the process of accurately filling out this form online.

Follow the steps to complete the IL A/114 form online.

- Press the ‘Get Form’ button to obtain the form and open it in the editor.

- In Part A, choose the basis of your claim by selecting the appropriate box regarding the Double Tax Convention.

- For Part B, provide a brief description of the transaction involved in the income and select the type of income received by checking the relevant boxes.

- In Part C, enter the full name, home address, and identification number of the recipient. Complete the additional details such as the date of birth and form of organization.

- Continue in Part C by indicating the fiscal residency of the recipient and whether they have been a resident of Israel.

- In Part D, fill in the payer’s full name, address, and identity number while specifying any relationships that exist between the payer and the recipient.

- In Part E, provide details of the income received, including the date, place, amount, and description of the income while answering relevant previous claims questions.

- Attach any necessary documentation in Part F related to the transaction.

- In Part G, ensure that the declarations of the recipient are signed, clearly stating the recipient's status as the beneficial owner.

- For Part H, if applicable, include certification from the Income Tax Authority of the recipient's country of residence.

- Once all sections are completed, save your changes, then download, print, or share the filled form as necessary.

Complete your documentation online to ensure a smooth filing process.

A 15% rate applies for payments from income derived during any period for which the paying corporation is entitled to the reduced tax rate applicable to an AE under Israel's Encouragement of Capital Investments Law (1959). A 25% rate applies in all other cases.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.