Loading

Get Micro Finance Application Form 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Micro Finance Application Form online

Filling out the Micro Finance Application Form online is a crucial step for users seeking financial assistance. This guide will walk you through each section of the form, ensuring you complete it accurately and efficiently.

Follow the steps to successfully fill out the application form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

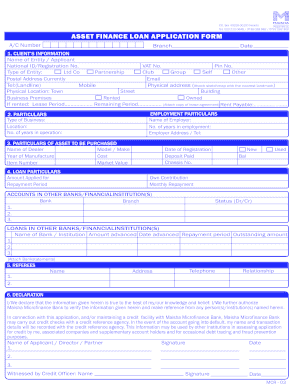

- Begin by providing your client’s information. Include your name (or entity name), national ID or registration number, VAT number, PIN number, and the type of entity (e.g., Ltd Company, Partnership). You will also need to enter your postal address, email, telephone numbers, and physical address details.

- Next, in the particulars section, indicate the type of business, its location, and the number of years it has been in operation.

- Fill out the employment particulars by providing the name of your employer, years in employment, and employer’s address and telephone number.

- Proceed to the particulars of the asset to be purchased. You must input the name of the dealer, model or make, year of manufacture, cost, item number, and market value.

- In the loan particulars section, state the amount you are applying for, the repayment period, date of registration, deposit paid, and chassis number. Specify whether the asset is new or used by marking the appropriate option.

- List any accounts you hold in other banks or financial institutions, noting the bank names, branches, and status of each account.

- Detail any loans in other banks or financial institutions by providing the name of the bank, amount advanced, date advanced, repayment period, and the outstanding amount. Attach the necessary bank statements.

- Complete the referees section by providing the names, addresses, telephone numbers, and relationships of two referees.

- Make a declaration by confirming that all provided information is accurate and authorize the institution to verify this information. Sign and date the application.

- Lastly, make sure to review the requirements section to ensure you meet the documentation needed based on your entity type, providing any necessary attachments such as identification documents, statements, and agreements.

- After filling out the form, save your changes and select the option to download, print, or share the form as needed.

Complete your Micro Finance Application Form online today!

The minimum capital for a microfinance institution (MFI) varies based on regulatory requirements in different regions. In the U.S., it usually ranges from $50,000 to several million dollars depending on the institution's structure and services offered. Each MFI must be adequately funded to support operations and ensure the availability of loans to clients.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.