Loading

Get Gp5479us 2021-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the GP5479US online

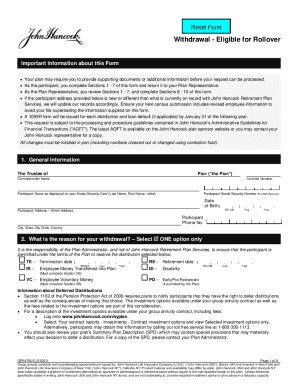

This guide provides a comprehensive overview of how to accurately complete the GP5479US online. Whether you are changing jobs or planning for retirement, understanding this form is crucial to managing your retirement savings effectively.

Follow the steps to successfully complete the GP5479US online.

- Click ‘Get Form’ button to obtain the GP5479US form and open it in the editor.

- Complete Section 1 with your personal details, including your name, Social Security Number, and contact information. Ensure all fields are filled accurately to prevent processing delays.

- In Section 2, select the reason for your withdrawal. You must choose one option that best describes your situation.

- Proceed to Section 3 to indicate the amount you wish to withdraw. Choose whether to withdraw 100% of your vested account value or a specific portion.

- In Section 4, specify what you wish to do with your funds. This includes options for direct rollover, payment, or leaving the money in the plan.

- Complete Section 5, detailing where you want the money sent. This section includes options for tax implications and account details for rollovers.

- Fill out Sections 6 and 7 regarding any waivers of waiting periods and your signature, confirming the accuracy of the information provided.

- Finally, review all sections to ensure completeness, save your changes, and follow the instructions for downloading or printing the form.

Complete your GP5479US form online today for a seamless transition of your retirement funds.

1. Avoid the 401(k) Early Withdrawal Penalty. If you withdraw money from your 401(k) account before age 59 1/2, you will need to pay a 10% early withdrawal penalty in addition to income tax on the distribution. For someone in the 24% tax bracket, a $5,000 early 401(k) withdrawal will cost $1,700 in taxes and penalties.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.