Loading

Get Mi Form 518 Schedule A - Liability Questionnaire 2018-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI Form 518 Schedule A - Liability Questionnaire online

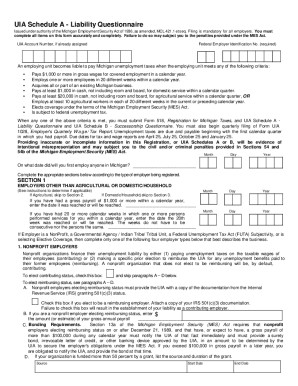

Filling out the MI Form 518 Schedule A - Liability Questionnaire is a crucial step for employers in Michigan who are subject to unemployment taxes. This guide will provide you with clear, step-by-step instructions to complete the form online accurately and confidently.

Follow the steps to fill out the MI Form 518 Schedule A - Liability Questionnaire successfully.

- Click ‘Get Form’ button to access the questionnaire and open it in the designated online editor.

- Begin by entering your UIA account number, if you have one already assigned. If you do not have an account number, you can leave this field blank.

- Fill in your Federal Employer Identification Number (FEIN), which is a required field for the form.

- Record the date you first employed anyone in Michigan by filling in the month, day, and year.

- Complete Section 1 for employers other than agricultural or domestic/household. If applicable, provide the required dates for your gross payroll milestones and total number of weeks employing individuals.

- If you are a nonprofit employer, indicate your status as contributing or reimbursing and provide any necessary documentation as instructed.

- For Section 2, agricultural employers must indicate total cash payroll and the number of agricultural workers within specified weeks.

- In Section 3, domestic/household employers should enter the relevant cash payroll information.

- Complete Section 4 by printing the names and titles of all owners or officers, obtaining their signatures, and providing their contact telephone numbers.

- After you have filled out all sections accurately, review the information provided for any errors. Once confirmed, you can save your changes, download a copy of the form, print it for your records, or share it as necessary.

Complete your documents online today to ensure you meet all filing requirements efficiently.

The online registration eliminates the need to complete and mail in the 'Form 518, Michigan Business Tax Registration' booklet. After completing this on-line application, you will receive a confirmation number of your electronic submission.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.