Loading

Get Canada Ibc Claim Form No. 3 Gst 2006-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada IBC Claim Form No. 3 GST online

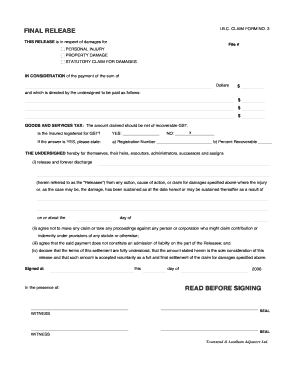

The Canada IBC Claim Form No. 3 GST is essential for individuals seeking compensation for personal injuries, property damage, or statutory claims. This guide provides clear, step-by-step instructions for accurately completing the form online.

Follow the steps to effectively complete the Canada IBC Claim Form No. 3 GST.

- Use the ‘Get Form’ button to access the form online and open it in your preferred editor.

- In the 'File #' section, enter the unique reference number related to your claim. This is vital for tracking purposes.

- For the 'Personal Injury' or 'Property Damage' sections, check the appropriate box to specify the type of claim you are filing.

- In the 'In consideration of the payment of the sum of' section, fill in the dollar amount being claimed, ensuring it reflects the net amount after recoverable Goods and Services Tax (GST) has been accounted for.

- Indicate whether the insured individual is registered for GST by checking 'Yes' or 'No'. If 'Yes', provide the registration number and the percentage recoverable.

- In the release sections, carefully read the statements, and ensure you understand the implications. Here, you acknowledge the release of claims against the Releasee.

- Sign and date the document. It’s important to have your signature witnessed. Ensure that the witness signs and dates the form as well.

- Once completed, review the form for accuracy, and then save your changes. You can download and print the form, or choose to share it as needed.

Complete your documents online to ensure efficient processing and swift resolution of your claims.

To file an insurance claim for your business, start by contacting your insurance provider to report the incident. Gather all necessary information, including documentation of the damages and incidents, and ask if any specific forms are required, such as the Canada IBC Claim Form No. 3 GST. Completing this process could make it easier for you to receive the assistance you need.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.