Loading

Get Au Dhs Form Fa048 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AU DHS Form FA048 online

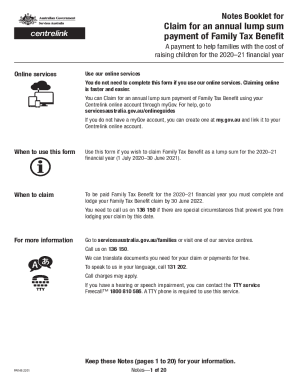

Filling out the AU DHS Form FA048 for an annual lump sum payment of Family Tax Benefit can seem daunting, but this guide will simplify the process for you. By following the steps outlined below, you will clearly understand each section of the form and know what information is needed to complete it successfully.

Follow the steps to fill out the form accurately and efficiently.

- Click the ‘Get Form’ button to access the form and open it in your preferred online editor.

- Read through the introductory section of the form to understand your eligibility and the benefits available. This section will help set the context for your claim.

- Fill in your personal details including your full name, date of birth, and current address as prompted in the form.

- If applicable, enter your partner's details, ensuring to provide their name and other required information accurately.

- Confirm any previous names if applicable. Include details such as name at birth or any other aliases.

- Fill in the tax file number section. Ensure to provide the correct numbers for both you and your partner, as these are necessary for your claim.

- Complete the sections regarding your relationship status and any previous partners if relevant. This includes the details of any previous relationships during the specified period.

- Provide details of your children, including their names, dates of birth, and whether they have been enrolled in Medicare. This is critical for verifying eligibility.

- You will need to provide documentation that confirms details such as proof of birth for your children or legal documents if the care has changed.

- Review your entire form to ensure all information is complete and accurate before submission.

- Once you have completed the form, you can submit it online through your Centrelink online account, or follow instructions to return it by post.

- After submission, save a copy of your completed form for your own records and await confirmation from Services Australia.

Get started now and successfully complete your AU DHS Form FA048 online!

For your first child, the maximum total amount you can receive is $1,924.65 for the 13 weeks. For subsequent children the maximum total amount is $642.46 for the 13 weeks. If you're eligible for the Family Tax Benefit (FTB) Part A base rate or more, you'll get the maximum rate of Newborn Supplement.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.