Loading

Get Ma Form Sft-1 2015-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MA Form SFT-1 online

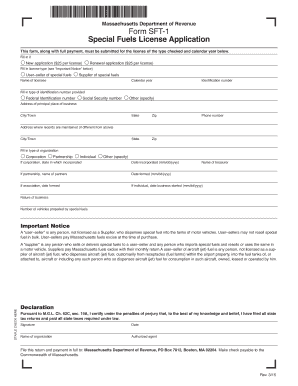

This guide provides clear instructions on how to fill out the Massachusetts Special Fuels License Application (Form SFT-1) online. Whether you are submitting a new application or renewing an existing one, this comprehensive guide will help you navigate the form with confidence.

Follow the steps to complete the MA Form SFT-1 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Select the type of application you are submitting: 'New application' for a new license or 'Renewal application' for renewing an existing license. Enter the type of license you require, choosing from user-seller of special fuels or supplier of special fuels.

- Provide the name of the licensee and the calendar year for which the license is applicable. Enter the identification number and specify the type of identification number provided, selecting from Federal Identification number, Social Security number, or other.

- Input the address of the principal place of business, including the city or town, state, and zip code. Also, include the phone number for the business.

- If the address where records are maintained differs from the business address, please fill in that information as well, along with the city or town.

- Indicate the type of organization by selecting from the options provided: Corporation, Partnership, Individual, or Other. If you select Corporation, specify the state in which it is incorporated and the date of incorporation in the format mm/dd/yyyy.

- Provide the name of the treasurer if applicable. If you are registering a partnership, list the names of the partners and the date the partnership was formed in the format mm/dd/yyyy.

- If the form is for an association, provide the date formed, or if it is for an individual, enter the date the business started in the format mm/dd/yyyy.

- Describe the nature of your business in the available space and indicate the number of vehicles propelled by special fuels.

- Review the important notice section carefully to ensure compliance with the definitions of user-sellers and suppliers.

- Complete the declaration section by certifying under penalties of perjury that all state tax returns have been filed, and all taxes required by law have been paid. Enter your signature, the date, name of the organization, and the authorized agent.

- Once all fields are completed, save your changes and use the options available to download, print, or share the form as required.

Complete your MA Form SFT-1 online today to ensure timely processing of your application.

Related links form

Tangible personal property is taxable in Massachusetts, with a few exceptions. These exceptions include clothing costing less than $175, most non-restaurant food and groceries, several health care and sanitation items, prescribed medical devices, and periodicals.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.