Loading

Get Canada Cf-fc 2265e 2015-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada CF-FC 2265E online

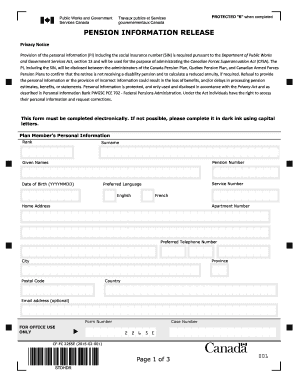

The Canada CF-FC 2265E is a fundamental form required for managing pension information for members of the Canadian Armed Forces. This guide will provide step-by-step instructions to help users complete the form accurately and efficiently online.

Follow the steps to fill out the Canada CF-FC 2265E form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the plan member's personal information in the designated sections. Fill in the rank, surname, given names, date of birth in the format YYYYMMDD, service number, and pension number.

- Select the preferred language by choosing either English or French.

- Enter the plan member's home address, including the apartment number, city, province, postal code, and country.

- Provide a preferred telephone number and, if desired, an email address where you can be contacted.

- In the statement of undertaking section, indicate your benefits status under the Canada Pension Plan (CPP) or Quebec Pension Plan (QPP) by checking the appropriate box.

- If applicable, fill in the plan member's social insurance number in the designated area.

- Sign and date the form to authorize the communication of the information to the pension administration.

- Review the completed form for accuracy and completeness.

- Once all fields are filled, save changes, download, print, or share the form as needed.

Complete your Canada CF-FC 2265E form online today.

To enlist in the Canadian military, there is no set term, but the typical commitment is around three to five years, depending on your role and agreement. After fulfilling your initial term, you may choose to extend your service or pursue retirement. For complete details on service requirements, consider the Canada CF-FC 2265E guidelines as a valuable resource.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.