Loading

Get Hi N-311 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the HI N-311 online

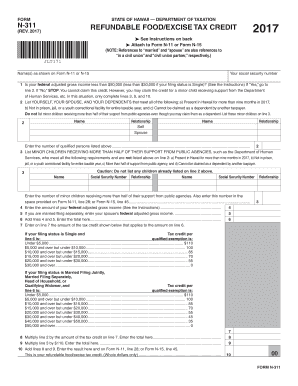

The HI N-311 form is essential for claiming the refundable food/excise tax credit in Hawaii. This guide will provide you with clear steps to fill out the form online, ensuring that you complete it accurately and efficiently.

Follow the steps to fill out the form accurately

- Press the ‘Get Form’ button to obtain the document and open it for editing.

- Begin by entering your name and that of your partner as shown on Form N-11 or N-15. Ensure correct spelling and full names.

- Input your social security number in the specified field.

- Answer the question regarding your federal adjusted gross income. If your income is below $50,000 (or $30,000 if your status is Single), proceed to the next step. If not, stop here as you cannot claim this credit.

- List yourself, your spouse, and your dependents who meet the residency and support criteria for the year 2017. Ensure to provide the relationship details accurately.

- Enter the number of qualified persons you listed in the previous step.

- For minor children receiving public support, provide their names and social security numbers. Ensure they meet the specified criteria.

- State your federal adjusted gross income as indicated in the instructions.

- If you are married filing separately, enter your spouse’s federal adjusted gross income.

- Calculate and enter the total of your and your spouse’s income.

- Utilize the credit table provided to determine the applicable tax credit based on the income total from the previous step.

- Multiply the number of qualified persons by the tax credit amount obtained.

- Add the total from the previous step to the amount calculated for minor children receiving support.

- This total is your refundable food/excise tax credit; ensure to record it on the relevant lines of Forms N-11 or N-15.

- Review the completed form for accuracy, then save your changes, and download, print, or share the form as needed.

Complete your HI N-311 form online today to claim your refundable food/excise tax credit.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Generally, a Hawaii individual income tax return must be filed with the Department of Taxation for each year in which an individual has gross income that exceeds the amount of his or her personal exemptions and standard deduction.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.