Loading

Get 12474-a 2000-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 12474-A online

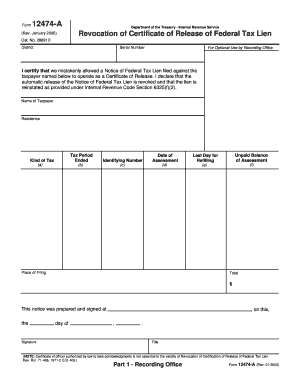

Filling out the 12474-A form is a crucial step for anyone needing to revoke a Certificate of Release of a Federal Tax Lien. This guide provides clear and detailed instructions to help individuals complete this form accurately and efficiently.

Follow the steps to successfully complete the 12474-A form.

- Click ‘Get Form’ button to obtain the form and access it in the online editor.

- Enter the name of the taxpayer in the designated field labeled 'Name of Taxpayer'. Ensure that the name is correctly spelled and matches the official record.

- Provide the taxpayer's residence address in the 'Residence' section. Include complete details, such as street address, city, state, and ZIP code.

- In the 'Tax Period Ended' field, input the date corresponding to the end of the tax period relevant to the lien. Use the correct date format.

- Fill in the 'Identifying Number' of the taxpayer, typically the Social Security Number or Employer Identification Number.

- Enter the 'Date of Assessment' which refers to the date the tax liability was assessed by the IRS.

- Indicate the 'Last Day for Refilling' in the appropriate section, which is vital for compliance with deadlines.

- Provide the 'Unpaid Balance of Assessment'. This amount reflects any outstanding tax liability.

- Select the 'Kind of Tax' related to the lien, such as income tax or another type of federal tax.

- In the 'Place of Filing' section, specify where the tax lien was initially filed.

- Ensure to complete all necessary fields before saving your progress.

- After completing the form, save your changes, and choose to download, print, or share the completed form as required.

Complete your documents online today and ensure your filing is accurate.

You can access your federal tax account through a secure login at IRS.gov/account. View the amount you owe, along with details of your balance, your payment history, tax records, and key tax return information from your most recent tax return as originally filed.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.