Loading

Get Ut Tc-922 2008-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UT TC-922 online

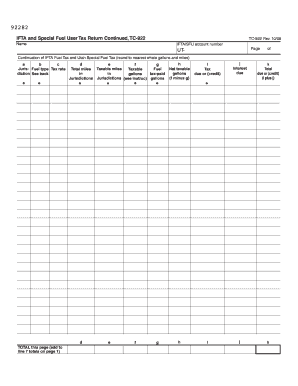

The UT TC-922 is an important document for filing the International Fuel Tax Agreement (IFTA) and special fuel user taxes. This guide will provide step-by-step instructions to help you complete the form accurately and efficiently online.

Follow the steps to complete the UT TC-922 online.

- Click the ‘Get Form’ button to access the form and open it in your preferred editor.

- Begin by entering your name in the designated field at the top of the form.

- Input your IFTA/SFU account number in the appropriate section.

- In the continuation section, accurately document the jurisdictions, fuel types, tax rates, total miles, taxable miles, and the gallons of tax-paid fuel. Ensure that all figures are rounded to the nearest whole gallon and mile.

- Calculate the total taxable gallons by subtracting the gallons reported in the various jurisdictions from the total taxable gallons you've entered.

- Determine the tax due or any applicable credits based on your calculations, and record that in the designated field.

- Include any interest due as well as the total due or credit by adding the tax due and interest amounts.

- Once all fields are completed, make sure to review your entries for accuracy.

- Finally, save your changes, and you may choose to download, print, or share the form as needed.

Complete your document online today for a seamless filing experience.

If you don't receive your refund in 21 days, your tax return might need further review. This may happen if your return was incomplete or incorrect. The IRS may send you instructions through the mail if it needs additional information in order to process your return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.