Loading

Get Ny Tr-692 2015-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY TR-692 online

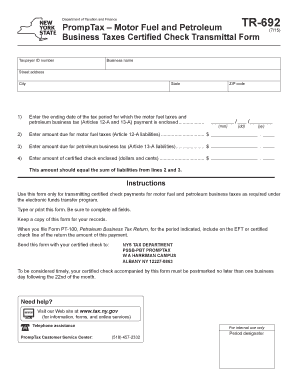

The NY TR-692 form is a certified check transmittal form used for payments related to motor fuel and petroleum business taxes. This guide provides clear and supportive instructions to help users accurately complete the form online.

Follow the steps to fill out the NY TR-692 accurately

- Click ‘Get Form’ button to access the NY TR-692 form and open it in the online editor.

- Provide your taxpayer ID number in the designated field to identify your business.

- Enter your business name in the corresponding field, ensuring accuracy for proper identification.

- Input your street address, followed by the city, state, and ZIP code in the required fields.

- Indicate the ending date of the tax period for which you are making the payment by filling in the month (mm) and year (yy) in the allotted spaces.

- Enter the amount due for motor fuel taxes (Article 12-A liabilities) in the appropriate section.

- Fill in the amount due for petroleum business tax (Article 13-A liabilities) in the next field.

- Specify the total amount of the certified check enclosed in the designated area, ensuring it matches the sum of the amounts from steps 6 and 7.

- Review all entered information for accuracy and completeness before finalizing.

- Once satisfied with the form, save your changes, and you may download, print, or share the completed form as needed.

Complete your documents online with confidence and efficiency.

Sales and use tax rates in New York State reflect a combined statewide rate of 4%, plus the local rate in effect in the jurisdiction (city, county, or school district) where the sale or other transaction or use occurs.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.