Loading

Get Mi Mi-1045 2017-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI MI-1045 online

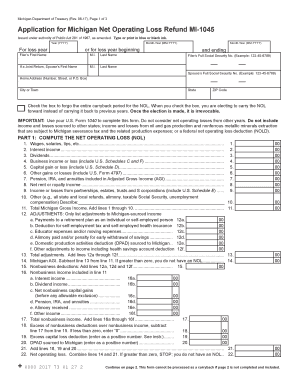

The MI MI-1045 form is an essential document for individuals or entities seeking a refund for net operating losses incurred in Michigan. This guide offers clear, step-by-step instructions to help users efficiently complete the form online.

Follow the steps to accurately complete the MI MI-1045 form.

- Click ‘Get Form’ button to obtain the MI MI-1045 and open it in the editor.

- Begin by entering the year for which you are claiming a net operating loss (NOL). Make sure to type the year in YYYY format, ensuring accuracy for processing.

- Fill in the names as required. Provide your first name and last name. If filing a joint return, also include your partner's first name and last name. Ensure each name is filled accurately, as it must match the tax documents.

- Enter your full Social Security number and your partner’s Social Security number if applicable. Be careful to format the numbers correctly as specified in the instructions.

- Complete the home address section. Include the number, street, city, state, and ZIP code correctly to ensure your form is processed without delays.

- Decide whether you want to forgo the entire carryback period for the NOL. If so, check the box provided. Remember, this election is irrevocable once made.

- Move to Part 1 where you compute the net operating loss. Carefully input data in each field based on the total income or losses as required, including wages, business income, capital gains, and other specified incomes.

- Summarize the total Michigan gross income by adding lines as indicated. Ensure you are only including income sourced from Michigan.

- Adjustments are crucial. Include any payments to retirement plans and deductions applicable. Follow the line-by-line directions to ensure accurate calculations.

- Calculate the Net Operating Loss based upon your entries. Confirm the computations by ensuring your calculations adhere to the guidelines provided.

- After completing all sections, review your entries for accuracy. Save your changes, download, or print the completed form. Share it with the necessary tax authorities as instructed.

Start filling out your MI MI-1045 online to ensure you receive the refund you deserve.

MI-1045) is used to compute the Michigan net operating loss (NOL) and is now filed with the loss year return (including e-filed returns). Michigan Net Operating Loss Deduction (Form 5674) is used to compute the current year Michigan NOL deduction. Form 5674 is required to claim an NOL deduction on Schedule 1.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.