Loading

Get Md Mw508 2012-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MD MW508 online

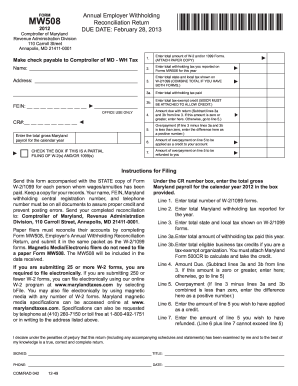

The MD MW508 form is essential for employers to report annual withholding reconciliations to the Comptroller of Maryland. This guide will provide clear, step-by-step instructions to help users accurately complete and submit the form online.

Follow the steps to fill out the MD MW508 form online

- Click the ‘Get Form’ button to access the MD MW508 and open it in the designated editor.

- Enter the total amount of W-2 and/or 1099 forms submitted. Ensure to attach a paper copy of these forms with your submission.

- Document the total withholding tax reported on the Forms MW506 for the current year.

- Calculate the total state and local tax from the W-2/1099 forms. If you have both forms, combine these totals.

- For total withholding tax paid, input that amount in the designated field.

- If applicable, enter the total tax-exempt credit. Note that a Maryland Form 500CR must be attached to process this credit.

- Determine the amount due with the return by subtracting the total withholding tax paid and the tax-exempt credit from the total state and local tax. If this amount is zero or greater, enter it here; if less, proceed to the next step.

- If an overpayment exists, record the difference as a positive number.

- Indicate what amount of the overpayment you wish to apply as a credit on your account.

- Indicate the amount of the overpayment you would like refunded.

- Complete the form by adding your name, Federal Employer Identification Number (FEIN), and any other required information. Review all entries for accuracy.

- Once your form is completed, you can save your changes, download, print, or share the form as needed.

Ensure your tax compliance by completing the MD MW508 online today.

MD MW508 - Annual Employer Withholding Reconciliation Return. MI Form 5080 - Sales, Use and Withholding Taxes Monthly/Quarterly Return (and Form 5095) MI Form 5081 - Sales, Use and Withholding Taxes Annual Return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.