Loading

Get Oh Union Home Mortgage Fha Loan Submission Checklist 2015-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the OH Union Home Mortgage FHA Loan Submission Checklist online

Filling out the OH Union Home Mortgage FHA Loan Submission Checklist online is essential for ensuring your loan application processes smoothly. This comprehensive guide provides step-by-step instructions to help you complete each section accurately, ensuring all necessary information is provided.

Follow the steps to complete the FHA loan submission checklist.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

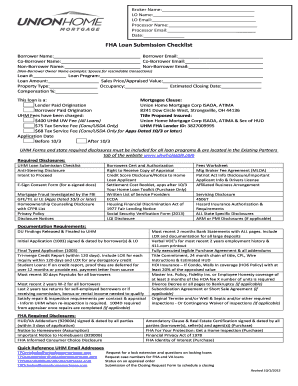

- Begin by entering the broker's name along with the loan officer's (LO) details, including their name and email address.

- Fill in the processor's name and email address, followed by the date of submission.

- Input the borrower's name and, if applicable, the co-borrower and non-borrower names along with their respective emails.

- Specify the loan number, loan program, loan amount, and sales price/appraised value, ensuring all financial figures are accurate.

- Indicate the property type, occupancy status, and estimated closing date to provide context for your loan application.

- Select the compensation percentage and clarify whether the loan is a lender-paid origination or borrower-paid origination.

- List any UHM fees that have been charged along with the title proposed insured, ensuring to include necessary details specified by the checklist.

- Ensure you include required disclosures, such as the UHM Loan Submission Checklist, Anti-Steering Disclosure, and other necessary forms outlined in the document.

- Gather and attach all documentation required as per the checklist, such as findings, applications, credit reports, and paystubs, to support your submission.

- Once all fields are completed and documents attached, review your submission for accuracy and completeness.

- After reviewing, save changes to your form, and choose options to download, print, or share the completed checklist as needed.

Complete your FHA loan submission checklist online today to ensure a smooth application process.

Ohio home buyer stats “Minimum” down payment assumes 3% down on a conventional mortgage with a minimum credit score of 620. If you're eligible for a VA loan (backed by the Department of Veterans Affairs) or a USDA loan (backed by the U.S. Department of Agriculture), you may not need any down payment at all.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.