Loading

Get Irs 2032 2002-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 2032 online

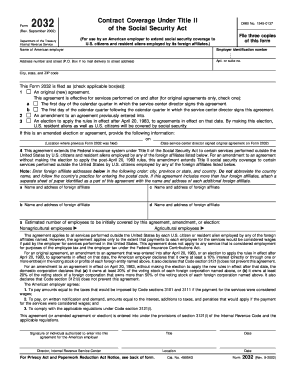

Filing the IRS 2032 form is essential for American employers looking to extend social security coverage to U.S. citizens and resident aliens employed by their foreign affiliates. This guide provides clear, step-by-step instructions on filling out the IRS 2032 online, ensuring you complete the process smoothly and accurately.

Follow the steps to complete the IRS 2032 form online.

- Press the ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Enter the name of the American employer in the designated field as it appears on official documentation.

- Provide the employer identification number, which is essential for IRS identification purposes.

- Fill out the address section, ensuring you include the street number, street name, and, if applicable, the P.O. Box information.

- Specify the type of agreement you are filing by checking the appropriate box. You can choose from an original, amended agreement, or an election.

- If filing an original agreement, indicate the effective date by checking one of the options given in the form.

- List the foreign affiliates’ names and addresses, ensuring you do not abbreviate the country names and follow local postal code practices.

- Estimate the number of employees that will be covered under this agreement and check the relevant boxes for agricultural or nonagricultural employees.

- Review the requirements for ownership interests in foreign entities and confirm that the relevant declarations are made.

- Sign and date the form in the space provided by an individual authorized to enter into the agreement on behalf of the American employer.

- Once completed, save changes, and download the form. You may also print or share it as needed.

Complete your IRS 2032 form online today to ensure compliance and extend necessary coverage.

§2032, Alternate Valuation In the case of property distributed, sold, exchanged, or otherwise disposed of, within 6 months after the decedent's death such property shall be valued as of the date of distribution, sale, exchange, or other disposition.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.