Get What Is A South Carolina 41 Form 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the What Is A South Carolina 41 Form online

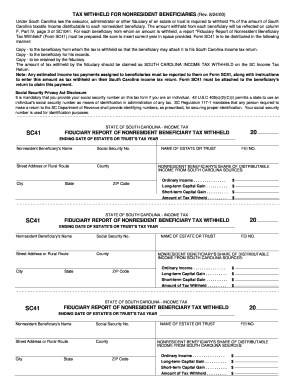

The South Carolina 41 Form, officially known as the Fiduciary Report of Nonresident Beneficiary Tax Withheld, is essential for reporting the tax withheld from nonresident beneficiaries of estates or trusts. This guide provides a detailed, step-by-step walkthrough for filling out this form online, ensuring accurate completion and compliance with state requirements.

Follow the steps to complete the South Carolina 41 Form online:

- Press the 'Get Form' button to access the document and open it in your preferred editor.

- Begin by entering the ending date of the estate's or trust's tax year. This date is critical for accurate reporting.

- Fill in the nonresident beneficiary's name in the designated field. Ensure that the name matches the legal documentation to avoid any issues.

- Provide the social security number of the nonresident beneficiary, as this is required for identification purposes according to state regulations.

- Complete the beneficiary's street address, rural route (if applicable), city, county, state, and zip code to ensure proper delivery of information.

- In the section titled 'Name of Estate or Trust,' write the official name of the estate or trust to which this form pertains.

- Enter the Federal Employer Identification Number (FEI No.) in the provided space. This number must correspond accurately with IRS records.

- Detail the nonresident beneficiary's share of distributable income from South Carolina sources, breaking this down into ordinary income, long-term capital gains, and short-term capital gains, filling in the respective dollar amounts.

- Report the total amount of tax withheld from the beneficiary in the designated field. This should accurately reflect 7% of the taxable income.

- Review all the entries for accuracy to avoid any delays or complications. Correct any errors before proceeding.

- Once completed, save your changes, and you can then download, print, or share the form as needed.

Complete your South Carolina 41 Form online to ensure compliance with tax withholding requirements.

Yes, South Carolina does offer bonus depreciation in line with federal guidelines. This means you can take a larger deduction immediately for investments in qualifying business property. However, there may be specific limitations and rules governed by state regulations. Utilizing tools and resources from USLegalForms can help clarify these guidelines.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.