Loading

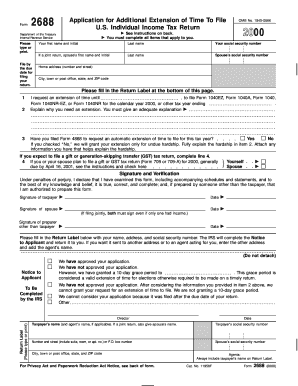

Get Irs 2688 2000-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 2688 online

Filing your tax return on time is important, but if you find that you need more time, the IRS 2688 form allows you to request an additional extension. This guide will provide you with a step-by-step approach on how to fill out the IRS 2688 online effectively.

Follow the steps to complete the IRS 2688 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the first field, enter your first name and initial. If you are filing jointly, also include your spouse’s first name and initial.

- Next, input your last name and, if applicable, your spouse’s last name.

- Provide your social security number and, if filing jointly, your spouse’s social security number.

- Fill in your home address, including the number and street, city, state, and ZIP code.

- Indicate the extension period you are requesting by filling in the date until which you seek to file your return.

- In the explanation section, describe why you require this extension. Be clear and thorough to avoid denial of your request.

- If you have filed Form 4868 previously, indicate whether it was submitted. If not, ensure your reason is based on undue hardship.

- For individuals or couples planning to file a gift or generation-skipping transfer tax return, check the appropriate boxes.

- In the signature section, both parties must sign if filing jointly. Include the date of signing.

- Complete the Return Label with your name, address, and social security number. Make sure this is accurate to receive a Notice from the IRS.

- Carefully review your entries to ensure that all relevant sections are filled. Save your changes, download the form, print it, or share it as needed.

Complete your IRS 2688 form online today and ensure you file your taxes on time!

Use Form 2688 to ask for more time to file Form. 1040EZ, Form 1040A, Form 1040, Form. 1040NR-EZ, or Form 1040NR. Generally, use it only if you already asked for more time on Form 4868 (the “automatic” extension form) and that time was not enough.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.