Loading

Get Irs 5471 - Schedule P 2019-2025

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 5471 - Schedule P online

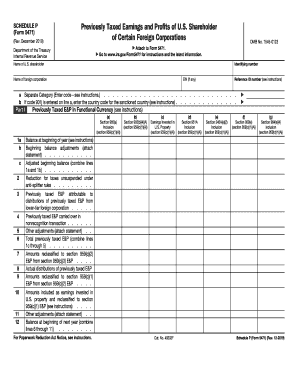

This guide provides a clear and supportive approach to completing the IRS 5471 - Schedule P form online. The Schedule P is essential for United States shareholders of certain foreign corporations, focusing on previously taxed earnings and profits. Follow these steps to ensure accurate and efficient filing.

Follow the steps to complete your Schedule P accurately.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online document editor.

- Enter the identifying number and the name of both the U.S. shareholder and the foreign corporation in the appropriate fields.

- In Part I, provide the previously taxed earnings and profits attributable to distributions from lower-tier foreign corporations. Fill in details starting from line 1c to line 5.

- List any amounts reclassified and actual distributions of previously taxed earnings and profits in sections for accurate reporting.

- For transactions involving U.S. property, ensure you complete sections relating to earnings invested in U.S. property, and make any necessary adjustments as instructed.

- In Part II, repeat the process for reporting previously taxed earnings and profits in U.S. dollars, maintaining accuracy in amounts and classifications.

- Finally, review all entries for completeness and accuracy. Save your changes, download, print, or share the completed form as required.

Start filling out your IRS 5471 - Schedule P online today!

Exploring How to Prepare Schedule P Form 5471 PTEP: One of the most complicated aspects of operating a business is tracking PTEP – Previously Taxed Earnings and Profits. This is especially true for a CFC (Controlled Foreign Corporation).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.