Loading

Get Form 8948 2020-2025

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8948 online

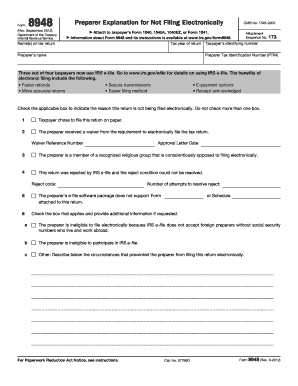

Filling out Form 8948 is an important step for taxpayers who need to explain why their returns are being filed on paper instead of electronically. This guide will walk you through the process step-by-step to ensure you complete the form accurately and efficiently.

Follow the steps to fill out Form 8948 online.

- Press the ‘Get Form’ button to obtain the form and access it in the editing environment.

- Enter the names of the taxpayers exactly as they appear on the tax return. Make sure to input the tax year of the return and the taxpayer's identifying number, which can be either a Social Security Number (SSN) or Employer Identification Number (EIN).

- Fill in the preparer's name and their Preparer Tax Identification Number (PTIN) in the designated fields. Double-check these for accuracy.

- Indicate the reason for not filing electronically by checking the appropriate box. Be sure not to check more than one box. If applicable, provide any additional requested information, such as waiver reference numbers or reject codes.

- After all sections are completed, review the entire form for any errors or missing information to ensure compliance.

- Once you have verified the form, you can save changes, download, print, or share the completed Form 8948 as required.

Complete your Form 8948 online today to streamline your filing process.

To fill out an export declaration form, start by providing the required information about the items being exported. This includes unit values, descriptions, and the export destination. Make sure to review your entries for accuracy to ensure compliance. If needed, Form 8948 can be included to report the related financial details tied to the exported goods.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.