Loading

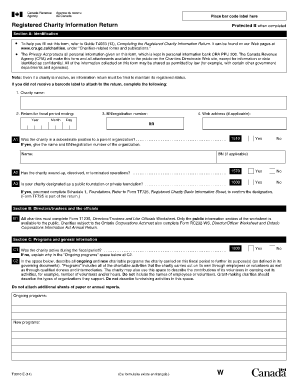

Get To Help You Fill Out This Form, Refer To Guide T4033 (13), Completing The Registered Charity

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the To Help You Fill Out This Form, Refer To Guide T4033 (13), Completing The Registered Charity online

This guide provides comprehensive instructions on how to complete the Registered Charity Information Return form as outlined in Guide T4033 (13). Follow these steps to accurately fill out the form online, ensuring compliance and effective reporting for your charity.

Follow the steps to complete your Registered Charity Information Return form online.

- Click ‘Get Form’ button to access the form and open it in your preferred editing tool.

- Section A: Identification - Start by filling out your charity's name, return period, and BN/registration number. If you did not receive a barcode label, provide the necessary details as requested regarding your charity's status.

- Question A1 to A3 - Answer the questions regarding your charity's status in relation to parent organizations and any operational status such as dissolution or designations. Make sure to provide additional required forms if applicable.

- Section B: Complete the Forms - Fill out Form T1235 for directors/trustees and any other required documentation as directed in this section.

- Section C: Programs and General Information - Indicate whether the charity was active during the fiscal period. Then, detail ongoing and new charitable programs that were carried out by your organization without attaching any extra pages.

- Continue through the following questions regarding fundraising activities, expenses, and any gifts to qualified donees. Fill in details as requested and refer to additional schedules if necessary.

- Section D: Financial Information - Complete this only if you are not required to fill out Schedule 6. Report on total assets, liabilities, and any administration costs.

- Section E: Certification - Ensure a director/trustee certifies the form by signing and providing their name, position, date, and contact number.

- Section F: Confidential Data - Provide the physical address of the charity, along with the name and address of the individual who completed the return.

- Finally, review all sections for accuracy, save your changes, and proceed to download or print the completed form for submission.

Complete your Registered Charity Information Return online today to ensure your charity remains compliant and registered.

What Is the T3010? Also known as Registered Charity Information Return, the T3010 form is an income tax return form for registered charities. Unlike personal income slips, T3010 comes with a checklist to ensure taxpayers fill it out as required by the CRA.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.