Loading

Get Uk Hmrc 64-8 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UK HMRC 64-8 online

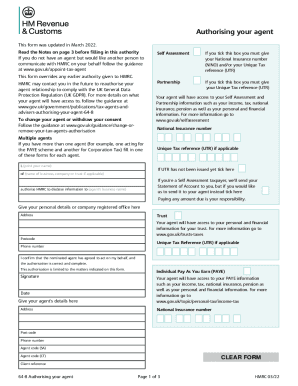

The UK HMRC 64-8 form is essential for authorizing an agent to manage your tax matters on your behalf. This guide will walk you through each section of the form, ensuring you complete it correctly and efficiently.

Follow the steps to complete the form seamlessly.

- Press the ‘Get Form’ button to access the form and open it in your preferred editor.

- In the ‘Self Assessment’ section, if you select the box, provide your National Insurance number (NINO) and/or Unique Tax Reference (UTR). This allows HMRC to identify your account accurately.

- If you are operating as a partnership, check the relevant box and include your UTR for partnership tax matters.

- Fill in your name and the name of the business, company, or trust as applicable. Ensure these are printed clearly.

- Authorise HMRC to share your information with the designated agent by including their business name and confirming their agreement to act on your behalf.

- Provide your personal details or the registered office address—including postcode and phone number—and ensure you accurately complete any UTR fields as necessary.

- If your agent will manage payment obligations, acknowledge that it is your responsibility to pay any amounts due.

- Complete the details for your agent, including their address, National Insurance number, and any relevant reference numbers (PAYE, VAT, CIS).

- Using the checkboxes, indicate how your agent should receive information. You can opt for them to receive details via online services, phone, or in writing.

- Before submitting, review all the provided information for accuracy. Ensure the designated agent's details are correct and complete.

- Once you have filled out pages one and two, send them to HMRC. Retain page three for your records.

Start filling out your UK HMRC 64-8 online today for efficient tax management.

You'll need an agent code to enrol each of these services onto your HMRC online services account and access the services to transact. To get a code for either Corporation Tax or Self Assessment, you need to apply for one in writing.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.