Loading

Get Form 6478

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 6478 online

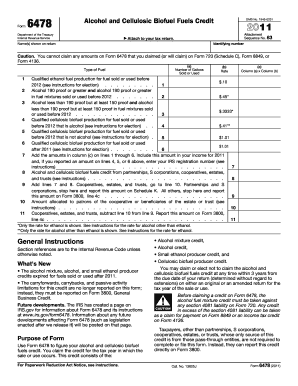

Filling out Form 6478, related to the alcohol and cellulosic biofuel fuels credit, is essential for eligible producers interested in claiming their benefits. This guide provides clear, step-by-step instructions to help you navigate the form online with ease.

Follow the steps to fill out Form 6478 accurately online.

- Click ‘Get Form’ button to download the form and access it in your preferred online editor.

- Enter your identifying number and the name(s) shown on your tax return in the corresponding fields.

- Complete the section for the number of gallons sold or used. You will find multiple lines corresponding to different types of fuel. For each line, state the appropriate number of gallons in column (a).

- Input the applicable rates for each type of fuel in column (b) based on the latest guidelines—ensure you refer to the specific rates for ethanol and alcohol other than ethanol.

- Calculate the total for each line by multiplying the values in column (a) by those in column (b), and enter the results in column (c).

- Add the totals from column (c) for lines 1 through 6 to determine your overall credit, which you must report as income.

- If applicable, input your IRS registration number for claiming the cellulosic biofuel producer credit.

- Complete any additional information required in relation to partnerships, S corporations, cooperatives, estates, or trusts, as detailed in the form.

- Review all entered information for accuracy and completeness, ensuring no required details are overlooked.

- Once all fields are filled out and confirmed, you can save changes, download the completed form, print it for your records, or share it as needed.

To maximize your benefits, ensure you complete and submit your Form 6478 online today.

To obtain Louisiana state tax forms, you can visit the Louisiana Department of Revenue’s official website. They provide downloadable versions of all necessary state forms. Additionally, for federal forms like Form 6497 or those related to tax credits, you can use online resources to ensure all your paperwork is in order.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.