Loading

Get Ar Dfa Ar1000es 2021

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AR DFA AR1000ES online

This guide aims to provide clear and concise instructions on completing the AR DFA AR1000ES form online. Whether you are a first-time taxpayer or familiar with the process, this comprehensive resource will support you every step of the way.

Follow the steps to complete the AR DFA AR1000ES form online

- Click ‘Get Form’ button to obtain the AR DFA AR1000ES form and open it in your preferred online editor.

- Begin by filling in your primary name and address details at the top of the form, ensuring accuracy for future correspondence.

- Input your Social Security number in the designated field. If applicable, provide your partner’s Social Security number.

- Specify the due date for your payment, which depends on whether you are filing for a calendar year or fiscal year.

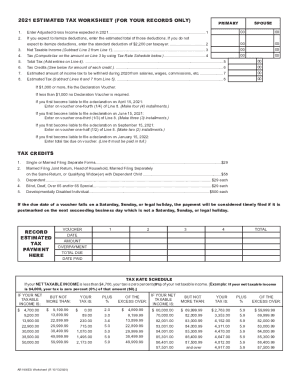

- Determine your estimated tax amount by referencing the Estimated Tax Worksheet included with the instructions and enter this amount in the appropriate section of the form.

- Ensure you round your payment amount to the nearest whole dollar before entering it.

- If you have a prior year overpayment that applies, make sure to indicate this in the specified area.

- Attach any required documentation, including payment methods such as checks or money orders made out to the Department of Finance and Administration.

- Review all entered information for accuracy before proceeding. Ensure that all fields are completed as required.

- Once satisfied with your entries, save changes to the form, download or print it for your records, or share it electronically as needed.

Get started on filing your AR DFA AR1000ES online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

You may get these vouchers if you're self-employed or had an uncharacteristic spike in your income this year. For example, you sold stock or took a large distribution from your retirement plan. You're not required to make estimated tax payments; we're just suggesting it based on the info in your return.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.