Loading

Get Profit And Loss Statement For Taxi Driver 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Profit And Loss Statement For Taxi Driver online

Filling out the Profit And Loss Statement for taxi drivers is essential for tracking the financial performance of your taxi business. This guide provides clear, step-by-step instructions to help you complete the form accurately and efficiently online.

Follow the steps to fill out your Profit And Loss Statement for taxi driver

- Click ‘Get Form’ button to access the Profit And Loss Statement for taxi driver and open it in your preferred editor.

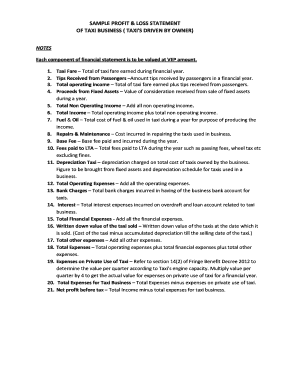

- Begin by filling in the 'Taxi Fare' section with the total amount of taxi fare earned during the financial year.

- Next, add the 'Tips Received from Passengers' to report the total amount of tips received during the financial year.

- Calculate the 'Total Operating Income' by summing the total taxi fare and tips received.

- Fill in the 'Proceeds from Fixed Assets' to report any income earned from the sale of fixed assets during the year.

- Add all non-operating income to complete the 'Total Non Operating Income' section.

- Calculate the 'Total Income' by combining the total operating income and total non-operating income.

- In the 'Fuel & Oil' section, enter the total cost of fuel and oil used in your taxi for the financial year.

- Provide the cost incurred in 'Repairs & Maintenance' for any repairs made to the taxis.

- Fill in the 'Base Fee' section with the base fee paid during the year for your taxi operations.

- Document the total fees paid to the Land Transport Authority (LTA) in the designated section.

- Report the 'Depreciation Taxi' to account for the reduction in value of the taxis owned over the year.

- Add all operating expenses to determine 'Total Operating Expenses'.

- Indicate 'Bank Charges' incurred for maintaining your taxi business bank account.

- Report any 'Interest' expenses related to overdrafts or loans associated with your taxi business.

- Calculate 'Total Financial Expenses' by summing all financial expenses mentioned.

- In the 'Written down value of the taxi sold' section, compute the value of taxis sold based on accumulated depreciation.

- Total up any 'Total other expenses' incurred throughout the financial year.

- Calculate the 'Total Expenses' by adding up all operating, financial, and other expenses.

- Determine 'Expenses on Private Use of Taxi' based on the calculations specified in the guidelines.

- Finally, find the 'Total Expenses for Taxi Business' by subtracting the expenses on private use from total expenses.

- Calculate 'Net profit before tax' by subtracting 'Total Expenses for Taxi Business' from 'Total Income'.

- Once all fields are completed, you may save your changes, download the form, print it, or share it as needed.

Complete your Profit And Loss Statement for taxi driver online today.

Related links form

To identify profit or loss for your business, review your profit and loss statement regularly. It will outline revenue generated against costs incurred over a specific period. For taxi drivers, capturing all expenses and earnings is crucial for a clear financial picture, ultimately allowing you to strategize better for sustained profitability.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.