Loading

Get Irs Employee Plan Audit Efficiency Guide

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Employee Plan Audit Efficiency Guide online

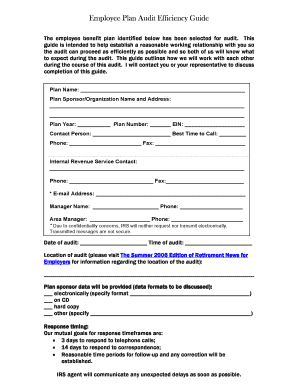

The IRS Employee Plan Audit Efficiency Guide is designed to facilitate a smoother audit process by fostering a productive working relationship between audit participants. This guide outlines essential information and steps needed to navigate the audit efficiently.

Follow the steps to complete the IRS Employee Plan Audit Efficiency Guide online.

- Click 'Get Form' button to obtain the form and open it for editing.

- Begin by filling out the plan name in the designated field at the top of the form. This should be the official name of the employee benefit plan being audited.

- In the section for 'Plan Sponsor/Organization Name and Address,' provide the full name and mailing address of the organization sponsoring the plan. Ensure that all information is accurate to avoid any delays.

- Complete the fields for 'Plan Year,' 'Plan Number,' and 'EIN' with the relevant details. These identifiers are crucial for the IRS to track and process the audit effectively.

- Designate a contact person who will be responsible for communication during the audit. Include their phone number and the best time to reach them.

- Fill in the details for the IRS contact, including their name, phone number, and fax number. This establishes a point of contact for any inquiries or updates.

- Specify the date and time of the audit in the provided fields, along with the location where the audit will take place. This information is essential for scheduling.

- Indicate how plan sponsor data will be provided by checking the appropriate boxes and specifying the format if electronically. This ensures clarity on the mode of data transfer.

- Review and list any documents that need to be provided prior to the audit. This preemptive action helps streamline the process significantly.

- Finally, ensure that you have all requested information organized and readily available at the time of the audit to avoid delays. After completing the form, save your changes, and proceed to download, print, or share the document as necessary.

Complete your IRS Employee Plan Audit Efficiency Guide online for a streamlined audit process.

Typically what happens to trigger an EDD audit is an independent contractor file for unemployment. Independent contractor is not eligible for unemployment benefits; so his claim triggers the EDD to look into the business practice.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.