Get Form 2 (revised) - Intuit Benefits 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 2 (Revised) - Intuit Benefits online

Filling out the Form 2 (Revised) - Intuit Benefits accurately is essential for ensuring your benefits are received by the right people. This guide provides a clear, step-by-step process to help you complete the form online with confidence.

Follow the steps to complete the Form 2 (Revised) - Intuit Benefits online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

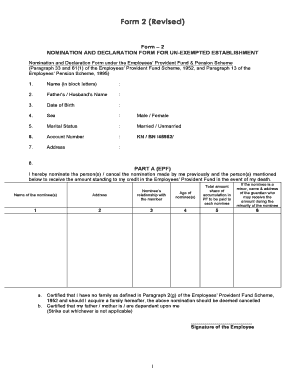

- Begin by entering your name in block letters in the designated field. Accuracy is crucial here, as this will be used for identification purposes.

- Provide your father’s or partner's name as required in the next field. This information may assist in verifying your identity.

- Input your date of birth in the specified format. Ensure the date is correct to avoid any future complications with your benefits.

- Select your sex by marking either 'Male' or 'Female' as applicable.

- Indicate your marital status by selecting either 'Married' or 'Unmarried'. This information is necessary for the benefits assessment.

- Enter your account number in the format specified. This will help in identifying your account in the Employees’ Provident Fund.

- Provide your current address clearly. Make sure to include all necessary details like street, city, state, and zip code.

- In PART A (EPF), list the names and addresses of the nominees you wish to designate. Include their relationship to you, age, and the total amount share for each nominee. If any nominee is a minor, provide the details of their guardian.

- Check the appropriate certification statements regarding your family status and ensure that your signature is provided for authentication in the designated field.

- In PART B (EPS), list the eligible family members for Widow/Children & Life Assurance benefits, including their names, addresses, age, and relationship to you.

- Designate a nominee for receiving the monthly pension, including their name, address, date of birth, and relationship to you.

- Finally, sign the form where indicated, ensuring all required fields are completed.

- Once the form is filled out completely, save your changes. You can download, print, or share the form as needed.

Complete your Form 2 (Revised) - Intuit Benefits online today for a smoother benefits process.

To file an amended return using Form 2 (Revised) - Intuit Benefits, first obtain the correct form from the Intuit platform. Carefully complete the sections that require changes, ensuring you provide accurate information. After filling it out, submit your amended return electronically through the Intuit system or mail it to the appropriate tax office, depending on your preference. This process helps ensure your tax record is accurate and up-to-date.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.