Loading

Get In State Form 53958 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IN State Form 53958 online

This guide provides clear instructions on how to complete the IN State Form 53958 online. Whether you are appealing a property assessment or correcting errors, following these steps will help simplify the process and ensure that your appeal is properly filed.

Follow the steps to fill out IN State Form 53958 online

- Click the ‘Get Form’ button to access the form and open it in your preferred document editor.

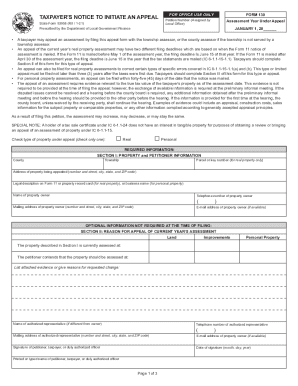

- Begin by entering the petition number and assessment year under appeal in the designated fields. Ensure that the assessment year corresponds with the year you are disputing.

- In Section I, provide the required property and petitioner information, including county, township, parcel or key number, address of the property, and contact details of the property owner. Make sure all entries are accurate for clear identification.

- Check the appropriate box to indicate whether you are appealing a real or personal property assessment. Completing this section correctly ensures that your appeal is processed appropriately.

- If applicable, complete Section II for the reason for the appeal of the current year's assessment. Provide details on the current assessment and your contention for the change, along with any attached evidence that supports your claim.

- For appeals based on corrections of errors, fill out Section III, specifying the type of errors made and justifying the requested changes in value. Clearly articulate the errors to ensure the review is taken seriously.

- Finally, review all the provided information for accuracy and completeness. When satisfied, you can save changes, download, print, or share the form as required to complete your submission.

Complete the IN State Form 53958 online to efficiently manage your property assessment appeals.

In Indiana, tax abatement is technically referred to as an economic revitalization area (ERA) deduction. The process begins with the designation of a certain piece of real estate as an ERA. Subsequent investment on that real estate, within state guidelines, is then eligible for tax abatement.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.